'Uneven' housing recovery continues

By Annalyn Censky, staff reporterApril 20, 2011: 12:12 PM ET

NEW YORK (CNNMoney) -- Sales of existing homes increased in March, "continuing an uneven recovery" in real estate, an industry group said Wednesday.

Home sales rose at an annual rate of 5.1 million in March, up 3.7% from February, the National Association of Realtors said Wednesday. However, sales were 6.3% lower than in March 2010.

Government reports released a day earlier showed new home construction and permits for future construction both ticked up in March.

Those reports are not bad, but not great either. Despite slight upticks in home sales and construction, the housing sector is still in the doldrums as supply continues to far outweigh demand for homes.

"Even as buyers scoop up deals of a lifetime, the river of foreclosed properties continues to flow," Douglas Porter, deputy chief economist at BMO Capital Markets, said in a note to investors Wednesday morning.

The median home price slipped 5.9% to $159,600, compared to a year earlier.

Meanwhile, some buyers are still finding it tough to get a mortgage, Lawrence Yun, chief economist for the National Association of Realtors, said in a release. The average credit score to get a conventional mortgage has risen to 760 from 720 in 2007.

"Although home sales are coming back without a federal stimulus, sales would be notably stronger if mortgage lending would return to the normal, safe standards that were in place a decade ago -- before the loose lending practices that created the unprecedented boom and bust cycle," he said.

First-time buyers purchased 33% of homes in March, down from 44% in March 2010. Investors accounted for 22% of sales, up from 19% a year ago.

All-cash sales were at a record high in March, accounting for 35% of existing home sales.

The report was roughly in line with economists' forecasts for home sales to grow at an annual rate of 5 million.

Friday, April 22, 2011

Thursday, April 21, 2011

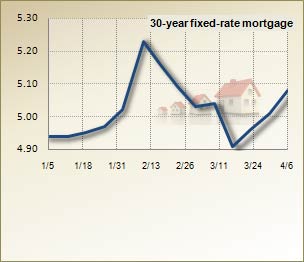

Mortgage rates sneak below 5 percent

Mortgage rates sneak below 5 percent

Mortgages rates took a notable dip this week as investors got mixed signals in the uncertain economic climate.

The benchmark 30-year fixed-rate mortgage fell 11 basis points this week, to 4.96 percent, according to the Bankrate.com national survey of large lenders. A basis point is one-hundredth of 1 percentage point. The mortgages in this week's survey had an average total of 0.44 discount and origination points. One year ago, the mortgage index was 5.35 percent; four weeks ago, it was 5.04 percent.

dropped 12 basis points, to 4.16 percent. The benchmark 5/1 adjustable-rate mortgage fell 13 basis points, to 3.7 percent.

Weekly national mortgage survey

Results of Bankrate.com's April 20, 2011, weekly national survey of large lenders and the effect on monthly payments for a $165,000 loan:

| 30-year fixed | 15-year fixed | 5-year ARM | |

| This week's rate: | 4.96% | 4.16% | 3.70% |

| Change from last week: | -0.11 | -0.12 | -0.13 |

| Monthly payment: | $881.73 | $1,233.76 | $759.47 |

| Change from last week: | -$11.10 | -$10.01 | -$12.18 |

What would the monthly payment be for you? Use Bankrate's mortgage calculator to find out.

The low rates have surprised some in the mortgage industry, including Rob Nunziata, president of FBC Mortgage in Orlando, Fla.

"We are seeing all the signs of inflationary pressure that will affect rates," he says. "Gas prices are going up, and some foreign countries have raised rates. But I think they are going to stay stable for at least a couple of weeks."

Rising inflation

The Consumer Price Index rose by 0.5 percent in March compared to February, according to the Department of Labor. In February, the index had risen another 0.5 percent from January. Consumer prices have climbed 2.7 percent in the last year.

"Inflation leads to higher mortgage rates," Nunziata says. "If things continue like this, a spike in rates will be inevitable in the next couple of months. I don't think it will be a huge spike though."

U.S. debt warning

Another factor that mortgage experts say could add pressure to interest rates is the rating of the U.S. debt. On Monday, Standard & Poor's changed its outlook on U.S. Treasury bonds from "stable" to "negative" and warned it might downgrade the U.S. debt from its top AAA rating if government officials don't get the country's budget deficit under control.

The threat hasn't caused much panic among investors yet, but a potential downgrade could pull nervous investors from the bond market to invest in the stock market, which would eventually cause a rise in interest rates.

"It remains to be seen what the impact of that would be, but the world needs to see our government can take this deficit seriously and address it in a coherent way," says Steve Majerus, regional vice president of First California Mortgage Co. in Petaluma, Calif. "It is a precursor to rates rising."

Improving job market

But it wasn't all bad news for the U.S. economy this week.

Data released Tuesday by the Department of Labor showed the job market has seen some improvement, which is a sign the economy may be strengthening.

Unemployment rates dropped in 34 states, and 38 states saw job gains in March, according to the department. The rate was unchanged in nine states and Washington, D.C., and rose in seven states.

What's good news for the economy may not be so rosy for the mortgage world.

In theory, a stronger job market reflects a stronger economy that could withstand higher rates. But with more than 14 million people still unemployed, the slight improvement in unemployment figures may not be enough to make a statement yet.

Why I'm not buying Zillow

Why I'm not buying Zillow

I'm all for rationalization of the ridiculously complex real estate transaction process. But Zillow hasn't provided the answer.

FORTUNE -- I nearly sold my house last fall. My wife had landed a new job, and it looked like we were going to move from Bronxville, NY to Philadelphia, PA. I was pretty relieved when her new employer gave us a reprieve and said we could stay put in New York. At least part of that relief came from the fact that I wouldn't be paying the enormous costs of selling a house, buying another one, and moving. By my calculation, it was going to "cost" us more than $50,000 to make the move, and that's before you even consider the prices of the houses themselves.

Like anyone with an Internet connection and an interest in real estate, I have been a user of Zillow.com for several years now. In an industry as opaque as real estate -- one that's replete with all sorts of screw-the-customer complexity, including title searches -- Zillow has offered a clarity and transparency that real estate agents, for all their "I'm-on-your-side" fakery, never have and never will. But the news that Zillow has filed to go public forces me to admit that I'm not a buyer of this franchise. Despite noble ambition, Zillow is nothing more than real estate porn, and by planning to raise $51.8 million in an IPO, it is merely looking to cash out its beleaguered venture investors, who have to date sunk $87 million into the business.

So what about that business? It looks good on the surface, I guess. Unique users of the site have more than doubled since 2008, climbing from 5.6 million to 12.7 million. Likewise, revenues have their own hockey-stick trajectory, climbing from $10.6 million in 2008 to $30.5 million in 2010. Losses, too, have been shrinking, from $21.9 million in 2008 to just $6.8 million in 2010. All the indicators are headed in the right direction here. So what's not to like?

First, any company that's planning an IPO will start shaving costs here and there in order to make the trends look good. I have no idea if Zillow's technology and development costs should have dropped from $15 million in 2008 to $10.7 million in 2010. Maybe they're just getting better at what they do, which is computerizing the real estate business. But I doubt it. Everything this company does is on the Internet; their technology costs are going to rise again, probably shortly after their IPO.

Second, it appears to me that Zillow has sold out. The original idea, as I recall, was that the site would bring a degree of transparency to an industry that had long resisted it. When I bought my house in 2005, I sat around a table with about 10 other people at the closing who all seemed to know each other -- my lawyer included -- and who talked as if my wife and I were not there before handing us bills totaling about $30,000.

Zillow was supposed to blow that cabal to smithereens. But a giant plank of Zillow's current growth plans seems to involve signing up agents who want to use Zillow as a listing service. I'm guessing the company's executives are too smart to bite the hands that feed them. If you and I don't pay a dime to Zillow, and agents do, you've got to wonder how ardent they remain about disaggregating the whole process so that you and I don't get burned every time.

The Zillow filing claims that lots of people are using their mobile devices (phones, iPads) to access its "proprietary" and "living" database. (That latter term is a new one to me. I am guessing it's just marketing. Who would claim they have a "dead" database?) But who cares how many people sit in their cars and punch in an address on Zillow in order to see the "value" of a house? The fact is that Zillow, which seemingly could have taken a bite out of the action of real estate transactions by scaring the oligopoly into submission, has demonstrably failed to do so. That they are courting real estate agents themselves is as big an admission of defeat as you might ask for.

Did I mention that Zillow has a dual-class stock structure? And guess what? They're not offering you the B shares. Enough said on that front.

Am I angry that Zillow hasn't provided a buyer for me using their proprietary "Make Me Move" function and my price of $850,000? No. (Still, interested buyers, see here.) Or that the current "Zestimate" of my house's value of $479,000 is almost $200,000 below my purchase price of $661,000 in 2005? No, I am not. (That said, I might be happier with the site if it understood the true value of the place.)

What I'm angry about is that Zillow might have been something that it hasn't turned out to be. The process of buying or selling a house hasn't changed at all since they arrived on the scene. The only thing that's happened is that someone else is taking another piece of the action. If you want a piece of that action, go ahead and buy. But there are better ways to bet on real estate than that.

I'm all for rationalization of the ridiculously complex real estate transaction process. But Zillow hasn't provided the answer.

FORTUNE -- I nearly sold my house last fall. My wife had landed a new job, and it looked like we were going to move from Bronxville, NY to Philadelphia, PA. I was pretty relieved when her new employer gave us a reprieve and said we could stay put in New York. At least part of that relief came from the fact that I wouldn't be paying the enormous costs of selling a house, buying another one, and moving. By my calculation, it was going to "cost" us more than $50,000 to make the move, and that's before you even consider the prices of the houses themselves.

Like anyone with an Internet connection and an interest in real estate, I have been a user of Zillow.com for several years now. In an industry as opaque as real estate -- one that's replete with all sorts of screw-the-customer complexity, including title searches -- Zillow has offered a clarity and transparency that real estate agents, for all their "I'm-on-your-side" fakery, never have and never will. But the news that Zillow has filed to go public forces me to admit that I'm not a buyer of this franchise. Despite noble ambition, Zillow is nothing more than real estate porn, and by planning to raise $51.8 million in an IPO, it is merely looking to cash out its beleaguered venture investors, who have to date sunk $87 million into the business.

So what about that business? It looks good on the surface, I guess. Unique users of the site have more than doubled since 2008, climbing from 5.6 million to 12.7 million. Likewise, revenues have their own hockey-stick trajectory, climbing from $10.6 million in 2008 to $30.5 million in 2010. Losses, too, have been shrinking, from $21.9 million in 2008 to just $6.8 million in 2010. All the indicators are headed in the right direction here. So what's not to like?

First, any company that's planning an IPO will start shaving costs here and there in order to make the trends look good. I have no idea if Zillow's technology and development costs should have dropped from $15 million in 2008 to $10.7 million in 2010. Maybe they're just getting better at what they do, which is computerizing the real estate business. But I doubt it. Everything this company does is on the Internet; their technology costs are going to rise again, probably shortly after their IPO.

Second, it appears to me that Zillow has sold out. The original idea, as I recall, was that the site would bring a degree of transparency to an industry that had long resisted it. When I bought my house in 2005, I sat around a table with about 10 other people at the closing who all seemed to know each other -- my lawyer included -- and who talked as if my wife and I were not there before handing us bills totaling about $30,000.

Zillow was supposed to blow that cabal to smithereens. But a giant plank of Zillow's current growth plans seems to involve signing up agents who want to use Zillow as a listing service. I'm guessing the company's executives are too smart to bite the hands that feed them. If you and I don't pay a dime to Zillow, and agents do, you've got to wonder how ardent they remain about disaggregating the whole process so that you and I don't get burned every time.

The Zillow filing claims that lots of people are using their mobile devices (phones, iPads) to access its "proprietary" and "living" database. (That latter term is a new one to me. I am guessing it's just marketing. Who would claim they have a "dead" database?) But who cares how many people sit in their cars and punch in an address on Zillow in order to see the "value" of a house? The fact is that Zillow, which seemingly could have taken a bite out of the action of real estate transactions by scaring the oligopoly into submission, has demonstrably failed to do so. That they are courting real estate agents themselves is as big an admission of defeat as you might ask for.

Did I mention that Zillow has a dual-class stock structure? And guess what? They're not offering you the B shares. Enough said on that front.

Am I angry that Zillow hasn't provided a buyer for me using their proprietary "Make Me Move" function and my price of $850,000? No. (Still, interested buyers, see here.) Or that the current "Zestimate" of my house's value of $479,000 is almost $200,000 below my purchase price of $661,000 in 2005? No, I am not. (That said, I might be happier with the site if it understood the true value of the place.)

What I'm angry about is that Zillow might have been something that it hasn't turned out to be. The process of buying or selling a house hasn't changed at all since they arrived on the scene. The only thing that's happened is that someone else is taking another piece of the action. If you want a piece of that action, go ahead and buy. But there are better ways to bet on real estate than that.

Wednesday, April 20, 2011

5 credit union perks for the little guy

Credit union perks for the little guy

Better than a big bank?

At credit unions, every person counts and they want you to know it.

Yes, they do usually offer lower fees and better service than big banks. They also serve up some neglected goodies worth scooping up, including discounts on events and cash-back incentives.

How do they pull this off? By pooling buying power.

Since credit unions are not-for-profits owned by their members, they return savings to their membership. For example, auto loan rates are usually 2 percent lower than they are at banks, says Anne Legg, chair of the Credit Union National Association's Marketing and Business Development Council.

"We have everything that big banks have and more," says Todd Pietzsch, spokesman at BECU, a credit union based in Tukwila, Wash. "But a lot of people don't understand the benefits."

To be sure, credit unions come in all shapes and sizes. Some are community based; others cater to specialized groups like police officers or teachers. Many Fortune 500 companies and universities also are affiliated with credit unions. Perks can be equally generous at all of them, says Legg.

Here's a sampling of the perks being offered at credit unions near you.

Credit unions typically offer lower loan rates.

But what about renegotiating loans if you fall behind? At credit unions, the process is usually simple. "You can do it in one phone call," Legg says. "We look at each independent loan to see opportunities."

Still, there may be restrictions, such as paying down part of your loan. And one downside is that renegotiating a loan can tarnish your credit score.

Find discounts on services, entertainment

With a large membership, credit unions can dish out lots of useful, fun discounts. BECU offers discount on sports tickets, tax preparation software and amusement parks, among other perks.

"We keep offering more every year," Pietzsch says. "It's got to be a quality product, though, that appeals to a broad base."

Based in Richmond, Va., Virginia Credit Union, which currently offers nine discounts on amusement parks, tax preparation and even travel, also offers a mortgage rebate of up to $1,500.

Also, Landmark Credit Union has services aimed at its Hispanic clients, including money transfer services to Mexico for people to send money back home, Ransom says.

Banks aren't the only ones dishing out incentives.

Credit unions offer some juicy ones, too. For example, OMNI Community Credit Union in Battle Creek, Mich., has offered cash-back rebates on checking accounts, savings and car loans.

Other credit unions offer cash incentives. At the time of writing, BECU had a membership program where you could get a higher interest rate on your first $500 in a checking or savings account by signing up for various services like online bill pay.

"Just because you don't have $100,000, we don't treat you differently," says Pietzsch.

Some credit unions also offer generous rewards programs. At Security Service Federal Credit Union in San Antonio, you can use its rewards debit and credit card program for merchandise, charitable contributions, travel or gift cards.

Credit unions are usually family oriented.

"You'll find a product for every lifestyle from the first checking account to retirement products," says Legg.

For example, there's a bevy of kid-friendly accounts. Chicago-based Alliant Credit Union has a Kidz Klub savings account that pays high dividends, includes a newsletter and comes with a special ID card. Affinity Federal Credit Union in Basking Ridge, N.J., has a College Planning Center, where advisers help members create a free financial plan to save for college. Many credit unions also offer college scholarships to members.

Credit union programs aimed at seniors can go beyond just retirement plans. Summit Credit Union in Madison, Wis., has a senior club with free perks like traveler's checks and ID theft recovery services.

Many credit unions also offer wide-ranging financial services, including brokerage accounts, life insurance

Better than a big bank?

At credit unions, every person counts and they want you to know it.

Yes, they do usually offer lower fees and better service than big banks. They also serve up some neglected goodies worth scooping up, including discounts on events and cash-back incentives.

How do they pull this off? By pooling buying power.

Since credit unions are not-for-profits owned by their members, they return savings to their membership. For example, auto loan rates are usually 2 percent lower than they are at banks, says Anne Legg, chair of the Credit Union National Association's Marketing and Business Development Council.

"We have everything that big banks have and more," says Todd Pietzsch, spokesman at BECU, a credit union based in Tukwila, Wash. "But a lot of people don't understand the benefits."

To be sure, credit unions come in all shapes and sizes. Some are community based; others cater to specialized groups like police officers or teachers. Many Fortune 500 companies and universities also are affiliated with credit unions. Perks can be equally generous at all of them, says Legg.

Here's a sampling of the perks being offered at credit unions near you.

Credit unions typically offer lower loan rates.

But what about renegotiating loans if you fall behind? At credit unions, the process is usually simple. "You can do it in one phone call," Legg says. "We look at each independent loan to see opportunities."

Still, there may be restrictions, such as paying down part of your loan. And one downside is that renegotiating a loan can tarnish your credit score.

Find discounts on services, entertainment

With a large membership, credit unions can dish out lots of useful, fun discounts. BECU offers discount on sports tickets, tax preparation software and amusement parks, among other perks.

"We keep offering more every year," Pietzsch says. "It's got to be a quality product, though, that appeals to a broad base."

Based in Richmond, Va., Virginia Credit Union, which currently offers nine discounts on amusement parks, tax preparation and even travel, also offers a mortgage rebate of up to $1,500.

Also, Landmark Credit Union has services aimed at its Hispanic clients, including money transfer services to Mexico for people to send money back home, Ransom says.

Banks aren't the only ones dishing out incentives.

Credit unions offer some juicy ones, too. For example, OMNI Community Credit Union in Battle Creek, Mich., has offered cash-back rebates on checking accounts, savings and car loans.

Other credit unions offer cash incentives. At the time of writing, BECU had a membership program where you could get a higher interest rate on your first $500 in a checking or savings account by signing up for various services like online bill pay.

"Just because you don't have $100,000, we don't treat you differently," says Pietzsch.

Some credit unions also offer generous rewards programs. At Security Service Federal Credit Union in San Antonio, you can use its rewards debit and credit card program for merchandise, charitable contributions, travel or gift cards.

Credit unions are usually family oriented.

"You'll find a product for every lifestyle from the first checking account to retirement products," says Legg.

For example, there's a bevy of kid-friendly accounts. Chicago-based Alliant Credit Union has a Kidz Klub savings account that pays high dividends, includes a newsletter and comes with a special ID card. Affinity Federal Credit Union in Basking Ridge, N.J., has a College Planning Center, where advisers help members create a free financial plan to save for college. Many credit unions also offer college scholarships to members.

Credit union programs aimed at seniors can go beyond just retirement plans. Summit Credit Union in Madison, Wis., has a senior club with free perks like traveler's checks and ID theft recovery services.

Many credit unions also offer wide-ranging financial services, including brokerage accounts, life insurance

Thursday, April 7, 2011

Prices are low! Mortgages cheap! But you can't get one

Prices are low! Mortgages cheap! But you can't get one

Mortgage rates are low, prices have fallen, and you may want to buy a Manhattan condo such as this unit in the Grammercy 19 building. But banks aren't wanting to lend -- even to good credit.

By Les Christie

NEW YORK (CNNMoney) -- Yep, mortgage interest rates are low, but there's a catch: It doesn't matter how cheap rates are if you can't get a loan.

And these days, only highly qualified borrowers can get financing -- let alone the best rates.

Nearly a quarter of people who apply for loans are turned down, according to the Federal Reserve.

"Good borrowers with one or two blemishes on their credit are being denied credit," said Lawrence Yun, chief economist for the National Association of Realtors.

The denial rates tell only half the story. Many potential buyers aren't even applying for loans because they assume they can't get one.

"A lot of people know it's very difficult to get a mortgage and they're not even trying," said Alan Rosenbaum, CEO of GuardHill Financial, a New York-based mortgage broker.

Who's buying homes? The rich

That shows up in credit scores for loans financed with backing from Fannie Mae and Freddie Mac. The average credit score has risen to 760 from 720 a few years ago. For FHA loans, the average score has gone to 700 from 660. Loans made to borrowers with sub-620 scores are almost nonexistent.

Another factor keeping people out of the mortgage market is that lenders now require much more up-front cash. The median down payment for purchase is about 15%. During the housing boom, it approached zero.

On most loans, banks want 20% down. On $200,000 purchases, that's $40,000, an insurmountable obstacle for many young house hunters. Or, in New York City, where the median home price is $800,000, buyers need $160,000 up front.

Industry insiders say all these factors have reduced the pool of buyers, lowering demand for homes and hurting prices.

"We feel it really reduces the demand for houses," said Mike D'Alonzo, president of the National Association of Mortgage Brokers. "It's an unbelievable buyer's market, but there hasn't been as much activity as you would expect because not as many people qualify for loans."

Jerry Howard, CEO of the National Association of Home Builders said, "You only have to look at the recent sales reports to see what the impact of the credit crunch has had. The statistics speak for themselves."

Sales of existing homes in February, despite very affordable prices, were 30% off their peak, and home prices fell for the sixth consecutive month in January.

Anthony Sanders, director of Real Estate Entrepreneurship at George Mason University, speculates the tougher credit standards may have stripped as much as 30% of the buyers off the market, compared with normal times.

And it's about to get harder for buyers. Federal regulators proposed rules last week that are designed to discourage risky lending but that will also likely further restrict lending.

Banks would be required to keep 5% of some loans, specifically those with less than 20% down payments, on their books rather than selling them all off as securities. As a result, banks make be unlikely to issue loans where less than 20% is put down. So much for first-time buyers.

"We think the new rules are appalling," said the NAHB's Howard. "Only the wealthy will be able to buy homes at low interest cost."

It could also further erode consumer demand for homes.

"It's disturbing," said Lennox Scott, head of John LA. Scott Real estate in the Pacific Northwest. "We're just starting to feel healthier in inventory levels and prices and this is a potential headwind."

The immediate impact, should the new regulations get adopted, should be minor, according to Steve O'Connor, spokesman for the Mortgage Bankers Association. That's because Fannie, Freddie and FHA loans are all exempt from the requirements and they represent more than 90% of the market right now.

The government, however, wants to reduce the presence of all three agencies in favor of private lenders, and banking experts fears the long-term impact of abandoning the field to mostly private companies.

"For the first time in 100 years," said Howard, "the government is discouraging you. It's saying 'We intend to make it more difficult for you and your kids to buy homes.'"

Mortgage rates are low, prices have fallen, and you may want to buy a Manhattan condo such as this unit in the Grammercy 19 building. But banks aren't wanting to lend -- even to good credit.

By Les Christie

NEW YORK (CNNMoney) -- Yep, mortgage interest rates are low, but there's a catch: It doesn't matter how cheap rates are if you can't get a loan.

And these days, only highly qualified borrowers can get financing -- let alone the best rates.

Nearly a quarter of people who apply for loans are turned down, according to the Federal Reserve.

"Good borrowers with one or two blemishes on their credit are being denied credit," said Lawrence Yun, chief economist for the National Association of Realtors.

The denial rates tell only half the story. Many potential buyers aren't even applying for loans because they assume they can't get one.

"A lot of people know it's very difficult to get a mortgage and they're not even trying," said Alan Rosenbaum, CEO of GuardHill Financial, a New York-based mortgage broker.

Who's buying homes? The rich

That shows up in credit scores for loans financed with backing from Fannie Mae and Freddie Mac. The average credit score has risen to 760 from 720 a few years ago. For FHA loans, the average score has gone to 700 from 660. Loans made to borrowers with sub-620 scores are almost nonexistent.

Another factor keeping people out of the mortgage market is that lenders now require much more up-front cash. The median down payment for purchase is about 15%. During the housing boom, it approached zero.

On most loans, banks want 20% down. On $200,000 purchases, that's $40,000, an insurmountable obstacle for many young house hunters. Or, in New York City, where the median home price is $800,000, buyers need $160,000 up front.

Industry insiders say all these factors have reduced the pool of buyers, lowering demand for homes and hurting prices.

"We feel it really reduces the demand for houses," said Mike D'Alonzo, president of the National Association of Mortgage Brokers. "It's an unbelievable buyer's market, but there hasn't been as much activity as you would expect because not as many people qualify for loans."

Jerry Howard, CEO of the National Association of Home Builders said, "You only have to look at the recent sales reports to see what the impact of the credit crunch has had. The statistics speak for themselves."

Sales of existing homes in February, despite very affordable prices, were 30% off their peak, and home prices fell for the sixth consecutive month in January.

Anthony Sanders, director of Real Estate Entrepreneurship at George Mason University, speculates the tougher credit standards may have stripped as much as 30% of the buyers off the market, compared with normal times.

And it's about to get harder for buyers. Federal regulators proposed rules last week that are designed to discourage risky lending but that will also likely further restrict lending.

Banks would be required to keep 5% of some loans, specifically those with less than 20% down payments, on their books rather than selling them all off as securities. As a result, banks make be unlikely to issue loans where less than 20% is put down. So much for first-time buyers.

"We think the new rules are appalling," said the NAHB's Howard. "Only the wealthy will be able to buy homes at low interest cost."

It could also further erode consumer demand for homes.

"It's disturbing," said Lennox Scott, head of John LA. Scott Real estate in the Pacific Northwest. "We're just starting to feel healthier in inventory levels and prices and this is a potential headwind."

The immediate impact, should the new regulations get adopted, should be minor, according to Steve O'Connor, spokesman for the Mortgage Bankers Association. That's because Fannie, Freddie and FHA loans are all exempt from the requirements and they represent more than 90% of the market right now.

The government, however, wants to reduce the presence of all three agencies in favor of private lenders, and banking experts fears the long-term impact of abandoning the field to mostly private companies.

"For the first time in 100 years," said Howard, "the government is discouraging you. It's saying 'We intend to make it more difficult for you and your kids to buy homes.'"

Subscribe to:

Comments (Atom)