5 nasty surprises that can stop your home purchase cold

Think the keys to your new dream home are as good as yours, do you? Not so fast. In this tough financial climate, some unexpected issues might scuttle the deal.

By Marilyn Lewis of MSN Real Estate

When a seller wants to sell a home and finds a buyer who wants to buy it, you'd think they'd have a deal. What could go wrong?

These days, plenty. In this tough financial climate, there are both longstanding pitfalls and a crop of new ones. At best, these can cost you time or money. Or both. At worst, the home you want could slip from your grasp.

1. The appraisal kills the deal

Even after you and the seller have agreed on a price, the appraiser — the expert assigned by the bank to authenticate the home's value — can ruin everything. (Bing: What are the latest appraisal rules?)

A little background: Your lender needs to know that the home you're buying is worth what you're paying. Banks are touchy on this subject at the moment. They own nearly 1 million foreclosed homes and stand to inherit millions more from defaulting borrowers. Your lender wants to be sure your new home won't be added to this pile.

Appraisers arrive at a home's value in part by comparing recent sales of nearby homes. But falling prices, and foreclosures and short sales in the neighborhood, make these comparisons tough.

Your sale can suffer if the appraiser doesn't know the neighborhood. Walter Molony, spokesman for the National Association of Realtors, says federal rules meant to prevent lenders and appraisers from getting too cozy have unintentionally increased pressure on appraisers, which he says has led to sloppy, hasty and inaccurate appraisals.

Case in point: Bryan Robertson, a Silicon Valley, Calif., agent with Sereno Group, recently had a client with a home for sale in a higher-end San Jose neighborhood. A buyer liked it and offered $1.06 million, not astronomical in this pricey region.

But the out-of-town appraiser said the home was worth $980,000, so the buyer's bank refused to lend more money. The dismayed buyer faced coughing up the difference — $80,000 — in cash or losing the deal.

June 2: TODAY real estate expert Barbara Corcoran explains why first-time home buyers should perform a trial run on mortgages and taxes before signing the contract on a new home.

With home values falling and distressed sales making comparisons difficult, appraisal problems are common:

Three-quarters of Century 21 agents surveyed recently blame low appraisals for buyers' problems getting financing.

In any given month, 10% of the National Association of Realtors' members see a sale die because of a low appraisal.

Another 10% of NAR members report sales were delayed by appraisal issues.

Occasionally, though, the buyer enjoys a silver lining: 15% of sellers agree to drop the price after a low appraisal, the NAR says.

Pre-emptive action: Choose an agent with deep experience in the neighborhood. Robertson, for example, could show the appraiser that several nearby homes of the same size and floor plan had sold for more. The appraiser revised the home's value to the price the buyer and seller had agreed upon.

2. Your lender demands home repairs

In this fussier climate, lenders may hold up a sale if the appraiser points out even minor repairs that need to be done. Bryan Wiley, a senior loan officer with Guild Mortgage Co. in Bellevue, Wash., says that when he worked for another company, he once had to delay a home purchase until window screens could be installed.

BuildersPaintingPlumbingRoofingSheds/EnclosuresSidingTileWindowsThe screens, included in the purchase contract, were nowhere in evidence. The appraiser pointed out the omission, so the bank's rules compelled him to withhold the loan.

"We couldn't get the loan documents out until the builder put up the screens and the appraiser signed off," Wiley says.

There's nothing new in lenders insisting that homes they finance be shipshape. But a few years ago, a lender might let the buyer and seller agree to complete the sale and fix any minor problems later, paying for them out of the seller's proceeds held in escrow. Today's buyers and sellers rarely are given that kind of slack.

Pre-emptive action: To anticipate issues an appraiser might raise, scrutinize the home inspector's report for any potential problems with the property. Also, be certain all conditions listed in your purchase and sale agreement are met.

3. The home has baggage

Remember any boyfriends or girlfriends from your past whom you fell for before realizing that he or she had deep "issues"? Homes can be like that, too. Some come with baggage.

Any surprises usually crop up when a title search is done to clear the way for your purchase.

For example, there's a chance, given all the financial turmoil these days, that someone besides your seller has a claim on the house. For this reason, many deals today "are not clean and easy," says David Townsend, an attorney and CEO of Agents National Title Insurance Co. For example:

A bankruptcy — not uncommon these days — may have produced creditors who have filed claims against the home to get what's owed them.

Your seller may have argued with a contractor who did work on the house years ago. Contractors or suppliers with beefs against the owner can file mechanic's liens against the property, preventing it from being sold until the claim is settled.

Maybe the seller lost a lawsuit and failed to pay — or perhaps didn't know about — a court judgment worth thousands of dollars. You can't buy the home until the debt is satisfied. Ditto for unpaid child support or alimony.

Missing permits are another deal-stopper, Townsend says. Sellers occasionally complete do-it-yourself remodeling and think, "What the heck, I don't need those expensive permits." But they do. Typically, the real-estate agent listing the home makes sure all permits are in order. But sometimes this escapes notice.

Occasionally, buyers are shocked to learn that the boundaries of the property they're buying aren't correct. Maybe the seller built a carport, addition, shed or fence that crossed onto a neighboring property. No one's the wiser until your title search uncovers the error. But you can't buy the place until the error is corrected. The seller may have to tear down the structure or negotiate with the neighbors to buy or sell a few feet of land. These problems can set back your purchase or end it altogether.

Pre-emptive action: Buy title insurance. "We've run into situations where errors have come out of the woodwork years later," Townsend says. With insurance, your claim to your home is protected. Warning: If an insurer declines to insure the title of a home you want to buy, walk away from the deal.

Wednesday, June 15, 2011

Thursday, June 9, 2011

Mortgages tumble to 7-month low

By Polyana da Costa • Bankrate.com

Mortgage rates fell again this week as investors grew more concerned about slow economic growth.

The benchmark 30-year fixed-rate mortgage fell 4 basis points this week, to 4.65 percent, according to the Bankrate.com national survey of large lenders. A basis point is one-hundredth of 1 percentage point. The mortgages in this week's survey had an average total of 0.39 discount and origination points. One year ago, the mortgage index was 4.88 percent; four weeks ago, it was 4.82 percent.

The benchmark 15-year fixed-rate mortgage fell 9 basis points, to 3.79 percent. The benchmark 5/1 adjustable-rate mortgage fell 4 basis points, to 3.35 percent.

The 30-year fixed rate has declined for nine weeks in a row and has not been this low since November, according to Bankrate's survey.

Weekly national mortgage survey

Results of Bankrate.com's June 8, 2011, weekly national survey of large lenders and the effect on monthly payments for a $165,000 loan:

30-year fixed 15-year fixed 5-year ARM

This week's rate: 4.65% 3.79% 3.35%

Change from last week: -0.04 -0.09 -0.04

Monthly payment: $850.80 $1,203.19 $727.18

Change from last week: -$3.96 -$7.40 -$3.65

Some mortgage experts had not expected another dip in rates this week, but their expectations quickly changed after Federal Reserve Chairman Ben Bernanke offered a gloomy assessment of the U.S. economy during a speech Tuesday.

Bernanke's speech

Bernanke acknowledged that U.S. economic growth is "frustratingly slow," adding the "jobs situation remains far from normal."

Most people already knew that based on recent economic reports. Still, Bernanke's speech immediately affected the mortgage market, causing stocks to fall as some investors pulled out of the stock market and sought safety by investing in U.S. bonds, says Michael Becker of Happy Mortgage in Lutherville, Md.

Early in the week, "it looked like rates were going to rise or stay the same," Becker says. "It's funny how much his words can move the market more than any type of report can."

Jobs report

The recent jobs report also helped keep rates low this week, says Deborah Holloway of Guaranty Mortgage in Melbourne, Fla.

Only 54,000 jobs were added to the economy in May, the fewest in eight months and a far cry from the more than 190,000 jobs that were created in each of the three previous months, according the U.S. Department of Labor. The unemployment rate reached 9.1 percent, up from 9 percent in April.

Even more concerning, according to Bernanke, is that nearly half of the unemployed people have been jobless for more than six months.

Prices, rates low but housing market still slow

The weak housing market hurts the economic recovery, Bernanke says.

"Low home prices and mortgage rates imply that housing is quite affordable by historical standards," he says. "Yet, with underwriting standards for home mortgages having tightened considerably, many potential homebuyers are unable to qualify for loans. Uncertainties about job prospects and the future course of house prices have also deterred potential buyers."

Volatile market

These gloomy economic outlooks, coupled with global economic uncertainty surrounding the debt issues in Europe, have caused mortgage rates to change more often than usual this week, says Dan Green of Waterstone Mortgage in Cincinnati.

"It's been a really bizarre week," he says. "On average, last month, rates changed every four hours and 19 minutes," Green says. "So far this month they are changing every three hours."

Unlike some mortgage experts who say rates will start rising again soon, Green expects rates will continue to decline "until there is explicit reason" to stop the fall. But he advises borrowers to take advantage of the low rates while they are available.

Holloway also says borrowers should lock.

"When they start shooting up they go up very quickly," Holloway says.

By Polyana da Costa • Bankrate.com

Mortgage rates fell again this week as investors grew more concerned about slow economic growth.

The benchmark 30-year fixed-rate mortgage fell 4 basis points this week, to 4.65 percent, according to the Bankrate.com national survey of large lenders. A basis point is one-hundredth of 1 percentage point. The mortgages in this week's survey had an average total of 0.39 discount and origination points. One year ago, the mortgage index was 4.88 percent; four weeks ago, it was 4.82 percent.

The benchmark 15-year fixed-rate mortgage fell 9 basis points, to 3.79 percent. The benchmark 5/1 adjustable-rate mortgage fell 4 basis points, to 3.35 percent.

The 30-year fixed rate has declined for nine weeks in a row and has not been this low since November, according to Bankrate's survey.

Weekly national mortgage survey

Results of Bankrate.com's June 8, 2011, weekly national survey of large lenders and the effect on monthly payments for a $165,000 loan:

30-year fixed 15-year fixed 5-year ARM

This week's rate: 4.65% 3.79% 3.35%

Change from last week: -0.04 -0.09 -0.04

Monthly payment: $850.80 $1,203.19 $727.18

Change from last week: -$3.96 -$7.40 -$3.65

Some mortgage experts had not expected another dip in rates this week, but their expectations quickly changed after Federal Reserve Chairman Ben Bernanke offered a gloomy assessment of the U.S. economy during a speech Tuesday.

Bernanke's speech

Bernanke acknowledged that U.S. economic growth is "frustratingly slow," adding the "jobs situation remains far from normal."

Most people already knew that based on recent economic reports. Still, Bernanke's speech immediately affected the mortgage market, causing stocks to fall as some investors pulled out of the stock market and sought safety by investing in U.S. bonds, says Michael Becker of Happy Mortgage in Lutherville, Md.

Early in the week, "it looked like rates were going to rise or stay the same," Becker says. "It's funny how much his words can move the market more than any type of report can."

Jobs report

The recent jobs report also helped keep rates low this week, says Deborah Holloway of Guaranty Mortgage in Melbourne, Fla.

Only 54,000 jobs were added to the economy in May, the fewest in eight months and a far cry from the more than 190,000 jobs that were created in each of the three previous months, according the U.S. Department of Labor. The unemployment rate reached 9.1 percent, up from 9 percent in April.

Even more concerning, according to Bernanke, is that nearly half of the unemployed people have been jobless for more than six months.

Prices, rates low but housing market still slow

The weak housing market hurts the economic recovery, Bernanke says.

"Low home prices and mortgage rates imply that housing is quite affordable by historical standards," he says. "Yet, with underwriting standards for home mortgages having tightened considerably, many potential homebuyers are unable to qualify for loans. Uncertainties about job prospects and the future course of house prices have also deterred potential buyers."

Volatile market

These gloomy economic outlooks, coupled with global economic uncertainty surrounding the debt issues in Europe, have caused mortgage rates to change more often than usual this week, says Dan Green of Waterstone Mortgage in Cincinnati.

"It's been a really bizarre week," he says. "On average, last month, rates changed every four hours and 19 minutes," Green says. "So far this month they are changing every three hours."

Unlike some mortgage experts who say rates will start rising again soon, Green expects rates will continue to decline "until there is explicit reason" to stop the fall. But he advises borrowers to take advantage of the low rates while they are available.

Holloway also says borrowers should lock.

"When they start shooting up they go up very quickly," Holloway says.

Thursday, May 5, 2011

Mortgage rates plunge

Mortgage rates plunge

Mortgage rates fell this week as investors sought safety, amid concerns of global instability and the still-weak economy.

Find the best mortgage rates in your area.The benchmark 30-year fixed-rate mortgage fell 7 basis points this week, to 4.88 percent, according to the Bankrate.com national survey of large lenders. A basis point is one-hundredth of 1 percentage point. The mortgages in this week's survey had an average total of 0.35 discount and origination points. One year ago, the mortgage index was 5.12 percent; four weeks ago, it was 5.08 percent.

The benchmark 15-year fixed-rate mortgage fell 9 basis points, to 4.05 percent. The benchmark 5/1 adjustable-rate mortgage fell 13 basis points, to 3.56 percent.

____________________________________________________________

Weekly national mortgage survey:

Results of Bankrate.com's May 4, 2011, weekly national survey of large lenders and the effect on monthly payments for a $165,000 loan:

30-year fixed 15-year fixed 5-year ARM

This week's rate: 4.88% 4.05% 3.56%

Change from last week: -0.07 -0.09 -0.13

Monthly payment: $873.69 $1,224.62 $746.46

Change from last week: -$7.03 -$7.47 -$12.07

_____________________________________________________________

The adjustable rates fell more than expected this week because one of the lenders surveyed by Bankrate.com revamped its line of mortgage products.

After dropping for four weeks in a row, fixed rates have reached their lowest since Bankrate's Dec. 1 survey, when the benchmark 30-year fixed was 4.71 percent.

"There seems to be a lot of forces coming together to keep rates low," says Dan Green of Waterstone Mortgage in Cincinnati.

Bin Laden's death

One factor that may contribute to keeping rates low for now is the fear of potential retaliation from terrorist groups after the death of Osama bin Laden. The United States kept its official threat level unchanged after the al-Qaida leader was killed in a U.S. raid in Pakistan this week, but security at many airports and subways was heightened.

While the killing of bin Laden itself did not have a direct and immediate impact on rates, the threat of potential retaliation is likely to affect rates, Green says.

"Any unexpected event, especially terrorism threats, tends to have a very deep impact on rates," Green says. "It's bad for the stock markets and good for the bond markets," and that normally leads to lower rates.

That's because during times of political uncertainty, nervous investors tend to pull money out of riskier investments, such as the stock market, and seek safer investments such as Treasury bonds. The higher demand for bonds causes yields to drop. Mortgage rates normally follow bond yields.

"Any time you have concerns or additional threats, you'll see a higher concentration of people investing in higher-quality, safer assets," says Cameron Findlay, chief economist at LendingTree.

Bad news for Europe means good news for mortgages

Another international event that may influence mortgage rates in the United States is the Greek debt crisis, Green says.

"To me, the Greece story is having the biggest impact," in driving investors into the U.S. bond market, he says.

Greece received a bailout of $160 billion last year but continues to struggle with its debt, which represents about 150 percent of its gross domestic product.

Ireland and Portugal also are in deep financial trouble.

While the U.S. economy is bad, the U.S. debt is still perceived as a much safer investment than the debt of some European countries, Findlay says.

"When you are swimming from a shark you don't have to be the fastest swimmer," Findlay says. "You just have to be faster than the guy next to you. As bad as the U.S. economy is performing, it is still performing better than the Greek economy."

Mortgage rates fell this week as investors sought safety, amid concerns of global instability and the still-weak economy.

Find the best mortgage rates in your area.The benchmark 30-year fixed-rate mortgage fell 7 basis points this week, to 4.88 percent, according to the Bankrate.com national survey of large lenders. A basis point is one-hundredth of 1 percentage point. The mortgages in this week's survey had an average total of 0.35 discount and origination points. One year ago, the mortgage index was 5.12 percent; four weeks ago, it was 5.08 percent.

The benchmark 15-year fixed-rate mortgage fell 9 basis points, to 4.05 percent. The benchmark 5/1 adjustable-rate mortgage fell 13 basis points, to 3.56 percent.

____________________________________________________________

Weekly national mortgage survey:

Results of Bankrate.com's May 4, 2011, weekly national survey of large lenders and the effect on monthly payments for a $165,000 loan:

30-year fixed 15-year fixed 5-year ARM

This week's rate: 4.88% 4.05% 3.56%

Change from last week: -0.07 -0.09 -0.13

Monthly payment: $873.69 $1,224.62 $746.46

Change from last week: -$7.03 -$7.47 -$12.07

_____________________________________________________________

The adjustable rates fell more than expected this week because one of the lenders surveyed by Bankrate.com revamped its line of mortgage products.

After dropping for four weeks in a row, fixed rates have reached their lowest since Bankrate's Dec. 1 survey, when the benchmark 30-year fixed was 4.71 percent.

"There seems to be a lot of forces coming together to keep rates low," says Dan Green of Waterstone Mortgage in Cincinnati.

Bin Laden's death

One factor that may contribute to keeping rates low for now is the fear of potential retaliation from terrorist groups after the death of Osama bin Laden. The United States kept its official threat level unchanged after the al-Qaida leader was killed in a U.S. raid in Pakistan this week, but security at many airports and subways was heightened.

While the killing of bin Laden itself did not have a direct and immediate impact on rates, the threat of potential retaliation is likely to affect rates, Green says.

"Any unexpected event, especially terrorism threats, tends to have a very deep impact on rates," Green says. "It's bad for the stock markets and good for the bond markets," and that normally leads to lower rates.

That's because during times of political uncertainty, nervous investors tend to pull money out of riskier investments, such as the stock market, and seek safer investments such as Treasury bonds. The higher demand for bonds causes yields to drop. Mortgage rates normally follow bond yields.

"Any time you have concerns or additional threats, you'll see a higher concentration of people investing in higher-quality, safer assets," says Cameron Findlay, chief economist at LendingTree.

Bad news for Europe means good news for mortgages

Another international event that may influence mortgage rates in the United States is the Greek debt crisis, Green says.

"To me, the Greece story is having the biggest impact," in driving investors into the U.S. bond market, he says.

Greece received a bailout of $160 billion last year but continues to struggle with its debt, which represents about 150 percent of its gross domestic product.

Ireland and Portugal also are in deep financial trouble.

While the U.S. economy is bad, the U.S. debt is still perceived as a much safer investment than the debt of some European countries, Findlay says.

"When you are swimming from a shark you don't have to be the fastest swimmer," Findlay says. "You just have to be faster than the guy next to you. As bad as the U.S. economy is performing, it is still performing better than the Greek economy."

Your Home: How to sell in tough times

Your Home: How to sell in tough times

Peter and Lauren Meyer of Montclair, N.J., had to make dramatic price cuts to nab a buyer. Their starting price in February 2010 was $1.149 million. After 5 price cuts, the home sold in November 2010 for $808,000.

By Amanda Gengler and Elizabeth Fenner

(MONEY Magazine) -- If you're in the market to sell your home, you probably feel you can't catch a break. Nearly five years into the housing bust, when many experts thought the real estate market would at least have stabilized, sales and prices are still dropping in most of the country.

In February existing-home sales tumbled 9.6% from the previous month, and the median price of a single-family home dropped to $157,000 from $163,900 the previous year, according to the National Association of Realtors. (Latest home prices)

You can't count on things turning around soon, either. At the current sales pace, it would take 8.6 months to clear out the 3.5 million existing homes listed today.

With the boost from the recent homebuyer tax credit gone, anyone who decides or is forced to put a house up for sale enters a market where houses often linger a full six months -- even a year -- without any bites.

Put part of the blame on stiff competition: Foreclosures and short sales, which accounted for 39% of sales in February, sell for about 15% less than conventional homes.

"It's dreadful out there for sellers," says Patrick Newport, a U.S. economist at forecasting firm IHS Global Insight.

Fortunately, there is one glimmer of good news. Bargain hunters, too, know that home prices are down some 32% from their peak. In a recent CNNMoney survey, three-quarters said that it was a good time to buy a home. But translating that interest into an actual sale can require some extreme measures.

It's not enough to show buyers your house is a deal: You have to convince them it's a total steal. That means slashing your price, bringing in a pro to pretty it up, and creating a killer website for your home. Here's how to do it right.

Slash Your Price, Bigtime

Sellers are still loath to accept the extent of the toll the bust took on their homes' value, says Tara-Nicholle Nelson, consumer educator for the housing website Trulia.com.

Many also give in to the temptation to list the property above fair market value to see what happens. Big mistake. About a quarter of sellers in the past year initially listed too high and were forced to knock the price lower, according to Trulia.com. Even in cities that have held up well, such as Charlotte, 25% of sellers resort to at least one price cut, and often two.

Think you can always drop the price if your home doesn't sell? Bigger mistake.

"The first 30 days on the market are the most important," says Norwalk, Conn., realtor Elizabeth Kamar. That's when your place attracts the most attention and gets the most showings. The result: You often end up with less than you would have if you priced it right to begin with, says Kamar. So get aggressive right out of the gate.

Undercut your competition. In normal times listings of similar properties in your area would give you a good sense of what your home might sell for. Today there's a big gap between what sellers want and what buyers are willing to pay.

Instead, figure out what you can realistically expect to get by asking your realtor to show you what houses similar to yours have sold for in the past three to six months. If more than a couple of the comparable properties were foreclosures or short sales, look closely at the photos and descriptions of those former listings. Distressed homes should be included in your comps if they are in move-in condition, says Las Vegas realtor Paul Bell.

Once you have a handle on your likely sale price, list your home a bit beneath that, says Rockaway, N.J., agent Ellen Klein. You don't have to undercut by much to attract attention, because that price will probably still be about 10% or 15% below what other homes are listed for. Even if you're competing with lots of foreclosures and short sales, your price should generate enough interest to attract more than one bidder, pushing up the final price to where it should be.

When Dorchester, Mass., realtor Julie Simmons wanted to sell her own home in January, she listed it at $460,000, about $5,000 to $10,000 below what she thought she'd sell for.

"I knew I had to attract attention," she says. Even in a harsh winter, she received four offers in less than two weeks -- and sold for $465,000.

Take out the ax. No bites within 30 days? Make a big move.

"When a property sits, people start thinking it must be listed too high," says Klein. To stimulate interest, make a giant cut -- as much as 10% of the asking price, and even more in an area where prices are still falling. That should be enough to warrant a second look from buyers who passed the first time, and to bring in a new pool of potentials who are hunting in the lower price range.

Last year Montclair, N.J., empty nesters Peter and Lauren Meyer decided to downsize from their seven-bedroom home to an apartment in the same town. They put their home on the market for $1.1 million, more than their realtor suggested. Six months and four price cuts later they pulled it off the market at $889,000.

"At that point we wrestled with lowering the price further, but we were ready to move on," says Peter. The couple relisted their home for $799,000 and it sold for $808,000.

Play hardball. It's okay to reject low-ball offers if a buyer won't budge. But if a buyer is willing to negotiate, push aside feelings of anger or insult and start counteroffering, says Mabel Guzman, president of the Chicago Association of Realtors.

Ideally you'll be able to negotiate within $10,000 to $20,000 of an acceptable offer. Then, "using incentives as carrots and sticks can make it easier to reach an agreement," says Guzman. For example, if your buyer refuses to dicker, you might offer to leave behind the appliances. Or maybe you'd rather take the reduced price but have the buyer agree that you take 60 days, not 30, to move out.

Hire a Stager:

There are people who want to sell, and there are people who have to sell. Kathy and Rex Roberts are among the latter. Based in West Hartford, Conn., the couple, who have two children, have been living in different cities since early December, when Rex, an IT auditor, started a new job in Silver Spring, Md., after a layoff.

Listed that same month, their solidly built three-bedroom 1956 colonial has had no offers, despite two price cuts (it's currently at $389,500). Between rent on Rex's new place and their carrying costs on the house, they're paying a budget-straining $4,000 a month. "We need to sell," says Rex, "but we're not willing to drop the price again."

So in March they tried something new: professional home staging. Staging, increasingly popular with homeowners trying to sell mid-range houses, can extend from simply rearranging existing furniture to repainting, replacing fixtures, and bringing in new furnishings. The goal: to highlight the house's best features while making it as easy as possible for buyers to imagine themselves living there. Veteran real estate brokers interviewed by MONEY say that proper staging can speed the sale and often increase the price too. The key is to get it done right.

Start with an open mind. Staging demands a psychological shift that many homeowners find challenging: thinking of your house not as your home but as a set. That means scrubbing away evidence that you actually live there. Your goal: the homey yet impersonal look of a Pottery Barn catalogue.

Find the right stager. The ASP (accredited staging professional) designation is a plus -- it indicates the stager has gone through some basic training -- but it isn't essential. Get names from realtors or at realestatestagingassociation.com, then review the stager's online portfolio of before-and-after photos. Next, call homeowner references and ask how fast their homes sold after staging and whether they think the work helped.

Establish a budget and ask the stager to work within it. Stagers typically charge $150 to $400 to walk through your home and give recommendations for each room. You can then execute the plan yourself or hire the stager to do it for an hourly fee, usually $100 or so, plus the cost of any new paint or furnishings.

If you make big changes, costs can add up -- but "I can often make a huge difference using what homeowners already have," says Mary D. Brooks, a stager and realtor from Breckenridge, Colo.

As for the Robertses, after getting advice from stager Kara Woods, owner of Stage to Move in Danbury, Conn., they painted their lavender dining room a soft gray and removed excess furniture, among other things; a professional stylist redid the living room (see above). "It's incredible how much bigger and more modern it looks," says Kathy.

These days it's going to take far more than a FOR SALE sign in the front yard and a spot on the multiple-listing service to get potential buyers in the door. That means getting the word out in a creative fashion -- and finding a realtor who is willing to do the same.

"The more eyeballs that get on the listing, the better," says Katie Curnutte of the real estate information website Zillow.com. To do that, you need a multipronged marketing plan of attack.

Create a great site. About 90% of buyers begin their search on the Internet, according to the National Association of Realtors. Make sure your home's online presence has a dozen or two photos: Having 20 instead of five photos will almost double the number of hits you'll get, according to Zillow.com. See the sidebar at right for more ways to keep potential buyers clicking on your site.

Throw money at them. Incentives can perk buyers' interest just as much as price cuts, says Matt Brown, director of business development at ForSaleByOwner.com. In fact, many buyers will agree to a higher price if their upfront costs are lowered, since they often run short on cash.

If you can afford it, offer to cover the buyer's closing costs or pay the first year's property taxes or condo or homeowner association dues. However, those freebies may be practically standard, particularly in areas rife with distressed properties.

In that case, says realtor Guzman, you might be able to bring buyers to the door by tossing in an unusual bonus, such as a $1,000 gift card (throw in one for the buyer's agent as well); a belonging they mentioned loving, such as the pool table or plasma TV; or a $5,000 credit to use in the home as they wish. (You can even pay upfront points so that they can get a lower mortgage rate, if you can swing it.)

Be aware, though, that you must disclose any such gifts or payments when the offer is agreed on, and some lenders will not approve them. If so, you might have to find another incentive that the bank doesn't object to.

Showcase super condition. Yes, some buyers are hunting for foreclosures in rough shape that they can nab for a song. Yet just as many shoppers don't want -- or don't know how -- to put in that sweat equity. So hire an inspector to identify every problem with the home, even seemingly minor issues such as dripping faucets, and fix them.

"If an outlet doesn't work, why get the buyer wondering what else is broken?" asks Beth Foley, an associate broker in Holland, Mich. Tell your realtor to give anyone who tours your home a copy of the inspection report and your list of fixes.

Spread the word online. Having your home listed on a major website like Realtor.com isn't enough. Ask your realtor if you'll get an "enhanced" listing on the site, where your home gets top promotional billing. Many realtors will create a website just for your home. You also want to get your listing on alternative sites like Craigslist or even Facebook.

In 2009, when Karen Mauro put her small, historic two-bedroom Orange County, Calif., home on the market she thought it would be a tough sale. Realtor Lisa Blanc listed the property at $467,500 and spread the word not only through the MLS listing but also with an update on her Facebook page. A Facebook friend of Blanc's passed the info to someone she knew was looking for that kind of house. Within a week, Mauro had an offer for $460,000.

Stay away -- far away. In better times you may not feel obliged to drop everything to accommodate prospective buyers' schedules. Today, if buyers can't get in on their time, they'll skip it, says Summer Greene, who manages realtors in the Fort Lauderdale area. So be prepared to show a perfectly clean home at a moment's notice. And disappear (along with your dog, if possible) for all showings and open houses so that prospects can imagine themselves in your house -- an impossible task when your family is vegging on the couch.

When Betty McCoy began showing her Prairie Village, Kans., three-bedroom Cape Cod - style house, for example, she kept a list of must-do chores -- including emptying wastebaskets, filling the dishwasher, and making the bed and walked out every morning with the place spotless. On the weekend she holed up at a local mall.

"Every time I thought I could go home, a new person wanted to see the house," recalls McCoy. But a few extra hours at the mall paid off in spades. In just a few days McCoy had an offer for her home -- for the full listing price.

Peter and Lauren Meyer of Montclair, N.J., had to make dramatic price cuts to nab a buyer. Their starting price in February 2010 was $1.149 million. After 5 price cuts, the home sold in November 2010 for $808,000.

By Amanda Gengler and Elizabeth Fenner

(MONEY Magazine) -- If you're in the market to sell your home, you probably feel you can't catch a break. Nearly five years into the housing bust, when many experts thought the real estate market would at least have stabilized, sales and prices are still dropping in most of the country.

In February existing-home sales tumbled 9.6% from the previous month, and the median price of a single-family home dropped to $157,000 from $163,900 the previous year, according to the National Association of Realtors. (Latest home prices)

You can't count on things turning around soon, either. At the current sales pace, it would take 8.6 months to clear out the 3.5 million existing homes listed today.

With the boost from the recent homebuyer tax credit gone, anyone who decides or is forced to put a house up for sale enters a market where houses often linger a full six months -- even a year -- without any bites.

Put part of the blame on stiff competition: Foreclosures and short sales, which accounted for 39% of sales in February, sell for about 15% less than conventional homes.

"It's dreadful out there for sellers," says Patrick Newport, a U.S. economist at forecasting firm IHS Global Insight.

Fortunately, there is one glimmer of good news. Bargain hunters, too, know that home prices are down some 32% from their peak. In a recent CNNMoney survey, three-quarters said that it was a good time to buy a home. But translating that interest into an actual sale can require some extreme measures.

It's not enough to show buyers your house is a deal: You have to convince them it's a total steal. That means slashing your price, bringing in a pro to pretty it up, and creating a killer website for your home. Here's how to do it right.

Slash Your Price, Bigtime

Sellers are still loath to accept the extent of the toll the bust took on their homes' value, says Tara-Nicholle Nelson, consumer educator for the housing website Trulia.com.

Many also give in to the temptation to list the property above fair market value to see what happens. Big mistake. About a quarter of sellers in the past year initially listed too high and were forced to knock the price lower, according to Trulia.com. Even in cities that have held up well, such as Charlotte, 25% of sellers resort to at least one price cut, and often two.

Think you can always drop the price if your home doesn't sell? Bigger mistake.

"The first 30 days on the market are the most important," says Norwalk, Conn., realtor Elizabeth Kamar. That's when your place attracts the most attention and gets the most showings. The result: You often end up with less than you would have if you priced it right to begin with, says Kamar. So get aggressive right out of the gate.

Undercut your competition. In normal times listings of similar properties in your area would give you a good sense of what your home might sell for. Today there's a big gap between what sellers want and what buyers are willing to pay.

Instead, figure out what you can realistically expect to get by asking your realtor to show you what houses similar to yours have sold for in the past three to six months. If more than a couple of the comparable properties were foreclosures or short sales, look closely at the photos and descriptions of those former listings. Distressed homes should be included in your comps if they are in move-in condition, says Las Vegas realtor Paul Bell.

Once you have a handle on your likely sale price, list your home a bit beneath that, says Rockaway, N.J., agent Ellen Klein. You don't have to undercut by much to attract attention, because that price will probably still be about 10% or 15% below what other homes are listed for. Even if you're competing with lots of foreclosures and short sales, your price should generate enough interest to attract more than one bidder, pushing up the final price to where it should be.

When Dorchester, Mass., realtor Julie Simmons wanted to sell her own home in January, she listed it at $460,000, about $5,000 to $10,000 below what she thought she'd sell for.

"I knew I had to attract attention," she says. Even in a harsh winter, she received four offers in less than two weeks -- and sold for $465,000.

Take out the ax. No bites within 30 days? Make a big move.

"When a property sits, people start thinking it must be listed too high," says Klein. To stimulate interest, make a giant cut -- as much as 10% of the asking price, and even more in an area where prices are still falling. That should be enough to warrant a second look from buyers who passed the first time, and to bring in a new pool of potentials who are hunting in the lower price range.

Last year Montclair, N.J., empty nesters Peter and Lauren Meyer decided to downsize from their seven-bedroom home to an apartment in the same town. They put their home on the market for $1.1 million, more than their realtor suggested. Six months and four price cuts later they pulled it off the market at $889,000.

"At that point we wrestled with lowering the price further, but we were ready to move on," says Peter. The couple relisted their home for $799,000 and it sold for $808,000.

Play hardball. It's okay to reject low-ball offers if a buyer won't budge. But if a buyer is willing to negotiate, push aside feelings of anger or insult and start counteroffering, says Mabel Guzman, president of the Chicago Association of Realtors.

Ideally you'll be able to negotiate within $10,000 to $20,000 of an acceptable offer. Then, "using incentives as carrots and sticks can make it easier to reach an agreement," says Guzman. For example, if your buyer refuses to dicker, you might offer to leave behind the appliances. Or maybe you'd rather take the reduced price but have the buyer agree that you take 60 days, not 30, to move out.

Hire a Stager:

There are people who want to sell, and there are people who have to sell. Kathy and Rex Roberts are among the latter. Based in West Hartford, Conn., the couple, who have two children, have been living in different cities since early December, when Rex, an IT auditor, started a new job in Silver Spring, Md., after a layoff.

Listed that same month, their solidly built three-bedroom 1956 colonial has had no offers, despite two price cuts (it's currently at $389,500). Between rent on Rex's new place and their carrying costs on the house, they're paying a budget-straining $4,000 a month. "We need to sell," says Rex, "but we're not willing to drop the price again."

So in March they tried something new: professional home staging. Staging, increasingly popular with homeowners trying to sell mid-range houses, can extend from simply rearranging existing furniture to repainting, replacing fixtures, and bringing in new furnishings. The goal: to highlight the house's best features while making it as easy as possible for buyers to imagine themselves living there. Veteran real estate brokers interviewed by MONEY say that proper staging can speed the sale and often increase the price too. The key is to get it done right.

Start with an open mind. Staging demands a psychological shift that many homeowners find challenging: thinking of your house not as your home but as a set. That means scrubbing away evidence that you actually live there. Your goal: the homey yet impersonal look of a Pottery Barn catalogue.

Find the right stager. The ASP (accredited staging professional) designation is a plus -- it indicates the stager has gone through some basic training -- but it isn't essential. Get names from realtors or at realestatestagingassociation.com, then review the stager's online portfolio of before-and-after photos. Next, call homeowner references and ask how fast their homes sold after staging and whether they think the work helped.

Establish a budget and ask the stager to work within it. Stagers typically charge $150 to $400 to walk through your home and give recommendations for each room. You can then execute the plan yourself or hire the stager to do it for an hourly fee, usually $100 or so, plus the cost of any new paint or furnishings.

If you make big changes, costs can add up -- but "I can often make a huge difference using what homeowners already have," says Mary D. Brooks, a stager and realtor from Breckenridge, Colo.

As for the Robertses, after getting advice from stager Kara Woods, owner of Stage to Move in Danbury, Conn., they painted their lavender dining room a soft gray and removed excess furniture, among other things; a professional stylist redid the living room (see above). "It's incredible how much bigger and more modern it looks," says Kathy.

These days it's going to take far more than a FOR SALE sign in the front yard and a spot on the multiple-listing service to get potential buyers in the door. That means getting the word out in a creative fashion -- and finding a realtor who is willing to do the same.

"The more eyeballs that get on the listing, the better," says Katie Curnutte of the real estate information website Zillow.com. To do that, you need a multipronged marketing plan of attack.

Create a great site. About 90% of buyers begin their search on the Internet, according to the National Association of Realtors. Make sure your home's online presence has a dozen or two photos: Having 20 instead of five photos will almost double the number of hits you'll get, according to Zillow.com. See the sidebar at right for more ways to keep potential buyers clicking on your site.

Throw money at them. Incentives can perk buyers' interest just as much as price cuts, says Matt Brown, director of business development at ForSaleByOwner.com. In fact, many buyers will agree to a higher price if their upfront costs are lowered, since they often run short on cash.

If you can afford it, offer to cover the buyer's closing costs or pay the first year's property taxes or condo or homeowner association dues. However, those freebies may be practically standard, particularly in areas rife with distressed properties.

In that case, says realtor Guzman, you might be able to bring buyers to the door by tossing in an unusual bonus, such as a $1,000 gift card (throw in one for the buyer's agent as well); a belonging they mentioned loving, such as the pool table or plasma TV; or a $5,000 credit to use in the home as they wish. (You can even pay upfront points so that they can get a lower mortgage rate, if you can swing it.)

Be aware, though, that you must disclose any such gifts or payments when the offer is agreed on, and some lenders will not approve them. If so, you might have to find another incentive that the bank doesn't object to.

Showcase super condition. Yes, some buyers are hunting for foreclosures in rough shape that they can nab for a song. Yet just as many shoppers don't want -- or don't know how -- to put in that sweat equity. So hire an inspector to identify every problem with the home, even seemingly minor issues such as dripping faucets, and fix them.

"If an outlet doesn't work, why get the buyer wondering what else is broken?" asks Beth Foley, an associate broker in Holland, Mich. Tell your realtor to give anyone who tours your home a copy of the inspection report and your list of fixes.

Spread the word online. Having your home listed on a major website like Realtor.com isn't enough. Ask your realtor if you'll get an "enhanced" listing on the site, where your home gets top promotional billing. Many realtors will create a website just for your home. You also want to get your listing on alternative sites like Craigslist or even Facebook.

In 2009, when Karen Mauro put her small, historic two-bedroom Orange County, Calif., home on the market she thought it would be a tough sale. Realtor Lisa Blanc listed the property at $467,500 and spread the word not only through the MLS listing but also with an update on her Facebook page. A Facebook friend of Blanc's passed the info to someone she knew was looking for that kind of house. Within a week, Mauro had an offer for $460,000.

Stay away -- far away. In better times you may not feel obliged to drop everything to accommodate prospective buyers' schedules. Today, if buyers can't get in on their time, they'll skip it, says Summer Greene, who manages realtors in the Fort Lauderdale area. So be prepared to show a perfectly clean home at a moment's notice. And disappear (along with your dog, if possible) for all showings and open houses so that prospects can imagine themselves in your house -- an impossible task when your family is vegging on the couch.

When Betty McCoy began showing her Prairie Village, Kans., three-bedroom Cape Cod - style house, for example, she kept a list of must-do chores -- including emptying wastebaskets, filling the dishwasher, and making the bed and walked out every morning with the place spotless. On the weekend she holed up at a local mall.

"Every time I thought I could go home, a new person wanted to see the house," recalls McCoy. But a few extra hours at the mall paid off in spades. In just a few days McCoy had an offer for her home -- for the full listing price.

Tuesday, May 3, 2011

Short sales are bargains, but they take forever

Short sales are bargains, but they take forever

Posted by Lisa Gibbs

In my April MONEY magazine story explaining how to snag a bargain purchasing a short sale or foreclosed home, I reported that the process can be both frustrating and time-consuming. Well, now I have first-hand knowledge of how slow and irksome these deals can be.

Wanting to take advantage of my own advice, my husband and I recently decided that the South Florida market where we live had sufficiently busted to make a cute three-bedroom townhouse nearby a pretty good investment. In February, we made an offer on that townhouse, which was listed as a short sale. Three months later, we don't have a response to our offer, and we've only just started hearing from the bank.

Not that I'm surprised. I heard all kinds of horror stories about short sales taking months when I was reporting my story. Just down the street from me, a house has been on the market for more than a year. The agent handling the sale, Toni Reeder, told me she had a buyer and an offer. But the bank took so long to approve a deal that the potential purchaser got discouraged and ended up buying another house in the neighborhood. So the first house still sits — now with a lower listing price.

Of course, there's more to the short sale mess than lenders dragging their feet. Banks complain of low-ball offers from buyers who aren't really serious, sellers who don't submit their documentation on time, and more. Experts say it's important when shopping for a distressed property to work with an agent experienced in short sales. What I learned is, even if your own agent has experience, you can still get held up.

Let's look at my situation. We made our first offer on Feb. 9. The seller had already moved out and was behind on his payments. It was up to the seller and his agent to submit the offer to the bank, along with a bunch of paperwork his loan servicer would need to approve him for the short sale.

We waited and waited. Nearly two months went by. My agent told me she'd been trying to get permission for our title company to deal directly with the bank — it always goes smoother that way, she said. Finally, she got it. Turned out that the seller apparently had not turned in the correct paperwork. So we started from scratch. We've had to redo much of our own work — the bank wants updated proof we have the cash to buy the home, for example. That's annoying, but at least something is happening.

Each one of these homes — the townhouse I'd like to buy, the other empty house down the street, and the stories I covered in my article — helps explain why the housing market is going to stay depressed for a while. "Short sales are not working at a very big-picture level, and more people are going into foreclosure than really should," says Ray Mathoda, a former IndyMac executive whose firm, AssetPlanUSA, now works with lenders to improve their systems for managing distressed properties. Her experience, she says, is that six out of 10 short sale contracts which get submitted to lenders never close.

This happens for a variety of reasons, she says: The buyer gets frustrated and walks. The seller doesn't get approved for a short sale, perhaps because the lender views it as a "strategic default" (the buyer can afford the payment but wants to ditch a home because it's fallen in value). Fraud. A poor process — the loan servicer loses paperwork, for example. Perhaps the investors who purchased the loan have unrealistic expectations about what the house is worth, or there's a second mortgage holder complicating the situation.

Government programs, such as Home Affordable Foreclosure Alternative (HAFA) should be working better than they are, and they'll have to if the country ever wants to get out of this morass of distressed properties, says Mathoda.

As someone who hopes to have one of the 40% of short sale contracts that successfully close, I have a suggestion from the buyer's perspective. When I see a home listed as a short sale, I have absolutely no certainty that the seller will qualify for a short sale or that the bank will accept anything near the listing price. It would be so much easier if the seller could work with his lender FIRST, before listing the house on the market, to get approved for the short sale and establish a price the bank has agreed to. Then I can make my offer knowing there's a reasonable chance it will be accepted. Maybe I'll even offer a higher price because I can feel confident of a quicker, simpler transaction.

Taking some of the uncertainty out of the process, seems to me, would go a long way toward luring wary buyers from the sidelines and, just maybe, getting our housing market back on track.

Posted by Lisa Gibbs

In my April MONEY magazine story explaining how to snag a bargain purchasing a short sale or foreclosed home, I reported that the process can be both frustrating and time-consuming. Well, now I have first-hand knowledge of how slow and irksome these deals can be.

Wanting to take advantage of my own advice, my husband and I recently decided that the South Florida market where we live had sufficiently busted to make a cute three-bedroom townhouse nearby a pretty good investment. In February, we made an offer on that townhouse, which was listed as a short sale. Three months later, we don't have a response to our offer, and we've only just started hearing from the bank.

Not that I'm surprised. I heard all kinds of horror stories about short sales taking months when I was reporting my story. Just down the street from me, a house has been on the market for more than a year. The agent handling the sale, Toni Reeder, told me she had a buyer and an offer. But the bank took so long to approve a deal that the potential purchaser got discouraged and ended up buying another house in the neighborhood. So the first house still sits — now with a lower listing price.

Of course, there's more to the short sale mess than lenders dragging their feet. Banks complain of low-ball offers from buyers who aren't really serious, sellers who don't submit their documentation on time, and more. Experts say it's important when shopping for a distressed property to work with an agent experienced in short sales. What I learned is, even if your own agent has experience, you can still get held up.

Let's look at my situation. We made our first offer on Feb. 9. The seller had already moved out and was behind on his payments. It was up to the seller and his agent to submit the offer to the bank, along with a bunch of paperwork his loan servicer would need to approve him for the short sale.

We waited and waited. Nearly two months went by. My agent told me she'd been trying to get permission for our title company to deal directly with the bank — it always goes smoother that way, she said. Finally, she got it. Turned out that the seller apparently had not turned in the correct paperwork. So we started from scratch. We've had to redo much of our own work — the bank wants updated proof we have the cash to buy the home, for example. That's annoying, but at least something is happening.

Each one of these homes — the townhouse I'd like to buy, the other empty house down the street, and the stories I covered in my article — helps explain why the housing market is going to stay depressed for a while. "Short sales are not working at a very big-picture level, and more people are going into foreclosure than really should," says Ray Mathoda, a former IndyMac executive whose firm, AssetPlanUSA, now works with lenders to improve their systems for managing distressed properties. Her experience, she says, is that six out of 10 short sale contracts which get submitted to lenders never close.

This happens for a variety of reasons, she says: The buyer gets frustrated and walks. The seller doesn't get approved for a short sale, perhaps because the lender views it as a "strategic default" (the buyer can afford the payment but wants to ditch a home because it's fallen in value). Fraud. A poor process — the loan servicer loses paperwork, for example. Perhaps the investors who purchased the loan have unrealistic expectations about what the house is worth, or there's a second mortgage holder complicating the situation.

Government programs, such as Home Affordable Foreclosure Alternative (HAFA) should be working better than they are, and they'll have to if the country ever wants to get out of this morass of distressed properties, says Mathoda.

As someone who hopes to have one of the 40% of short sale contracts that successfully close, I have a suggestion from the buyer's perspective. When I see a home listed as a short sale, I have absolutely no certainty that the seller will qualify for a short sale or that the bank will accept anything near the listing price. It would be so much easier if the seller could work with his lender FIRST, before listing the house on the market, to get approved for the short sale and establish a price the bank has agreed to. Then I can make my offer knowing there's a reasonable chance it will be accepted. Maybe I'll even offer a higher price because I can feel confident of a quicker, simpler transaction.

Taking some of the uncertainty out of the process, seems to me, would go a long way toward luring wary buyers from the sidelines and, just maybe, getting our housing market back on track.

Friday, April 22, 2011

'Uneven' housing recovery continues

'Uneven' housing recovery continues

By Annalyn Censky, staff reporterApril 20, 2011: 12:12 PM ET

NEW YORK (CNNMoney) -- Sales of existing homes increased in March, "continuing an uneven recovery" in real estate, an industry group said Wednesday.

Home sales rose at an annual rate of 5.1 million in March, up 3.7% from February, the National Association of Realtors said Wednesday. However, sales were 6.3% lower than in March 2010.

Government reports released a day earlier showed new home construction and permits for future construction both ticked up in March.

Those reports are not bad, but not great either. Despite slight upticks in home sales and construction, the housing sector is still in the doldrums as supply continues to far outweigh demand for homes.

"Even as buyers scoop up deals of a lifetime, the river of foreclosed properties continues to flow," Douglas Porter, deputy chief economist at BMO Capital Markets, said in a note to investors Wednesday morning.

The median home price slipped 5.9% to $159,600, compared to a year earlier.

Meanwhile, some buyers are still finding it tough to get a mortgage, Lawrence Yun, chief economist for the National Association of Realtors, said in a release. The average credit score to get a conventional mortgage has risen to 760 from 720 in 2007.

"Although home sales are coming back without a federal stimulus, sales would be notably stronger if mortgage lending would return to the normal, safe standards that were in place a decade ago -- before the loose lending practices that created the unprecedented boom and bust cycle," he said.

First-time buyers purchased 33% of homes in March, down from 44% in March 2010. Investors accounted for 22% of sales, up from 19% a year ago.

All-cash sales were at a record high in March, accounting for 35% of existing home sales.

The report was roughly in line with economists' forecasts for home sales to grow at an annual rate of 5 million.

By Annalyn Censky, staff reporterApril 20, 2011: 12:12 PM ET

NEW YORK (CNNMoney) -- Sales of existing homes increased in March, "continuing an uneven recovery" in real estate, an industry group said Wednesday.

Home sales rose at an annual rate of 5.1 million in March, up 3.7% from February, the National Association of Realtors said Wednesday. However, sales were 6.3% lower than in March 2010.

Government reports released a day earlier showed new home construction and permits for future construction both ticked up in March.

Those reports are not bad, but not great either. Despite slight upticks in home sales and construction, the housing sector is still in the doldrums as supply continues to far outweigh demand for homes.

"Even as buyers scoop up deals of a lifetime, the river of foreclosed properties continues to flow," Douglas Porter, deputy chief economist at BMO Capital Markets, said in a note to investors Wednesday morning.

The median home price slipped 5.9% to $159,600, compared to a year earlier.

Meanwhile, some buyers are still finding it tough to get a mortgage, Lawrence Yun, chief economist for the National Association of Realtors, said in a release. The average credit score to get a conventional mortgage has risen to 760 from 720 in 2007.

"Although home sales are coming back without a federal stimulus, sales would be notably stronger if mortgage lending would return to the normal, safe standards that were in place a decade ago -- before the loose lending practices that created the unprecedented boom and bust cycle," he said.

First-time buyers purchased 33% of homes in March, down from 44% in March 2010. Investors accounted for 22% of sales, up from 19% a year ago.

All-cash sales were at a record high in March, accounting for 35% of existing home sales.

The report was roughly in line with economists' forecasts for home sales to grow at an annual rate of 5 million.

Thursday, April 21, 2011

Mortgage rates sneak below 5 percent

Mortgage rates sneak below 5 percent

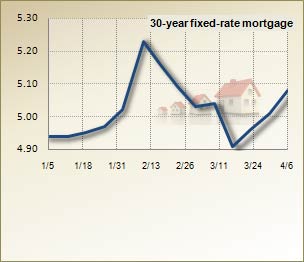

Mortgages rates took a notable dip this week as investors got mixed signals in the uncertain economic climate.

The benchmark 30-year fixed-rate mortgage fell 11 basis points this week, to 4.96 percent, according to the Bankrate.com national survey of large lenders. A basis point is one-hundredth of 1 percentage point. The mortgages in this week's survey had an average total of 0.44 discount and origination points. One year ago, the mortgage index was 5.35 percent; four weeks ago, it was 5.04 percent.

dropped 12 basis points, to 4.16 percent. The benchmark 5/1 adjustable-rate mortgage fell 13 basis points, to 3.7 percent.

Weekly national mortgage survey

Results of Bankrate.com's April 20, 2011, weekly national survey of large lenders and the effect on monthly payments for a $165,000 loan:

| 30-year fixed | 15-year fixed | 5-year ARM | |

| This week's rate: | 4.96% | 4.16% | 3.70% |

| Change from last week: | -0.11 | -0.12 | -0.13 |

| Monthly payment: | $881.73 | $1,233.76 | $759.47 |

| Change from last week: | -$11.10 | -$10.01 | -$12.18 |

What would the monthly payment be for you? Use Bankrate's mortgage calculator to find out.

The low rates have surprised some in the mortgage industry, including Rob Nunziata, president of FBC Mortgage in Orlando, Fla.

"We are seeing all the signs of inflationary pressure that will affect rates," he says. "Gas prices are going up, and some foreign countries have raised rates. But I think they are going to stay stable for at least a couple of weeks."

Rising inflation

The Consumer Price Index rose by 0.5 percent in March compared to February, according to the Department of Labor. In February, the index had risen another 0.5 percent from January. Consumer prices have climbed 2.7 percent in the last year.

"Inflation leads to higher mortgage rates," Nunziata says. "If things continue like this, a spike in rates will be inevitable in the next couple of months. I don't think it will be a huge spike though."

U.S. debt warning

Another factor that mortgage experts say could add pressure to interest rates is the rating of the U.S. debt. On Monday, Standard & Poor's changed its outlook on U.S. Treasury bonds from "stable" to "negative" and warned it might downgrade the U.S. debt from its top AAA rating if government officials don't get the country's budget deficit under control.

The threat hasn't caused much panic among investors yet, but a potential downgrade could pull nervous investors from the bond market to invest in the stock market, which would eventually cause a rise in interest rates.

"It remains to be seen what the impact of that would be, but the world needs to see our government can take this deficit seriously and address it in a coherent way," says Steve Majerus, regional vice president of First California Mortgage Co. in Petaluma, Calif. "It is a precursor to rates rising."

Improving job market

But it wasn't all bad news for the U.S. economy this week.

Data released Tuesday by the Department of Labor showed the job market has seen some improvement, which is a sign the economy may be strengthening.

Unemployment rates dropped in 34 states, and 38 states saw job gains in March, according to the department. The rate was unchanged in nine states and Washington, D.C., and rose in seven states.

What's good news for the economy may not be so rosy for the mortgage world.

In theory, a stronger job market reflects a stronger economy that could withstand higher rates. But with more than 14 million people still unemployed, the slight improvement in unemployment figures may not be enough to make a statement yet.

Why I'm not buying Zillow

Why I'm not buying Zillow

I'm all for rationalization of the ridiculously complex real estate transaction process. But Zillow hasn't provided the answer.

FORTUNE -- I nearly sold my house last fall. My wife had landed a new job, and it looked like we were going to move from Bronxville, NY to Philadelphia, PA. I was pretty relieved when her new employer gave us a reprieve and said we could stay put in New York. At least part of that relief came from the fact that I wouldn't be paying the enormous costs of selling a house, buying another one, and moving. By my calculation, it was going to "cost" us more than $50,000 to make the move, and that's before you even consider the prices of the houses themselves.

Like anyone with an Internet connection and an interest in real estate, I have been a user of Zillow.com for several years now. In an industry as opaque as real estate -- one that's replete with all sorts of screw-the-customer complexity, including title searches -- Zillow has offered a clarity and transparency that real estate agents, for all their "I'm-on-your-side" fakery, never have and never will. But the news that Zillow has filed to go public forces me to admit that I'm not a buyer of this franchise. Despite noble ambition, Zillow is nothing more than real estate porn, and by planning to raise $51.8 million in an IPO, it is merely looking to cash out its beleaguered venture investors, who have to date sunk $87 million into the business.

So what about that business? It looks good on the surface, I guess. Unique users of the site have more than doubled since 2008, climbing from 5.6 million to 12.7 million. Likewise, revenues have their own hockey-stick trajectory, climbing from $10.6 million in 2008 to $30.5 million in 2010. Losses, too, have been shrinking, from $21.9 million in 2008 to just $6.8 million in 2010. All the indicators are headed in the right direction here. So what's not to like?

First, any company that's planning an IPO will start shaving costs here and there in order to make the trends look good. I have no idea if Zillow's technology and development costs should have dropped from $15 million in 2008 to $10.7 million in 2010. Maybe they're just getting better at what they do, which is computerizing the real estate business. But I doubt it. Everything this company does is on the Internet; their technology costs are going to rise again, probably shortly after their IPO.

Second, it appears to me that Zillow has sold out. The original idea, as I recall, was that the site would bring a degree of transparency to an industry that had long resisted it. When I bought my house in 2005, I sat around a table with about 10 other people at the closing who all seemed to know each other -- my lawyer included -- and who talked as if my wife and I were not there before handing us bills totaling about $30,000.

Zillow was supposed to blow that cabal to smithereens. But a giant plank of Zillow's current growth plans seems to involve signing up agents who want to use Zillow as a listing service. I'm guessing the company's executives are too smart to bite the hands that feed them. If you and I don't pay a dime to Zillow, and agents do, you've got to wonder how ardent they remain about disaggregating the whole process so that you and I don't get burned every time.

The Zillow filing claims that lots of people are using their mobile devices (phones, iPads) to access its "proprietary" and "living" database. (That latter term is a new one to me. I am guessing it's just marketing. Who would claim they have a "dead" database?) But who cares how many people sit in their cars and punch in an address on Zillow in order to see the "value" of a house? The fact is that Zillow, which seemingly could have taken a bite out of the action of real estate transactions by scaring the oligopoly into submission, has demonstrably failed to do so. That they are courting real estate agents themselves is as big an admission of defeat as you might ask for.

Did I mention that Zillow has a dual-class stock structure? And guess what? They're not offering you the B shares. Enough said on that front.

Am I angry that Zillow hasn't provided a buyer for me using their proprietary "Make Me Move" function and my price of $850,000? No. (Still, interested buyers, see here.) Or that the current "Zestimate" of my house's value of $479,000 is almost $200,000 below my purchase price of $661,000 in 2005? No, I am not. (That said, I might be happier with the site if it understood the true value of the place.)

What I'm angry about is that Zillow might have been something that it hasn't turned out to be. The process of buying or selling a house hasn't changed at all since they arrived on the scene. The only thing that's happened is that someone else is taking another piece of the action. If you want a piece of that action, go ahead and buy. But there are better ways to bet on real estate than that.

I'm all for rationalization of the ridiculously complex real estate transaction process. But Zillow hasn't provided the answer.

FORTUNE -- I nearly sold my house last fall. My wife had landed a new job, and it looked like we were going to move from Bronxville, NY to Philadelphia, PA. I was pretty relieved when her new employer gave us a reprieve and said we could stay put in New York. At least part of that relief came from the fact that I wouldn't be paying the enormous costs of selling a house, buying another one, and moving. By my calculation, it was going to "cost" us more than $50,000 to make the move, and that's before you even consider the prices of the houses themselves.

Like anyone with an Internet connection and an interest in real estate, I have been a user of Zillow.com for several years now. In an industry as opaque as real estate -- one that's replete with all sorts of screw-the-customer complexity, including title searches -- Zillow has offered a clarity and transparency that real estate agents, for all their "I'm-on-your-side" fakery, never have and never will. But the news that Zillow has filed to go public forces me to admit that I'm not a buyer of this franchise. Despite noble ambition, Zillow is nothing more than real estate porn, and by planning to raise $51.8 million in an IPO, it is merely looking to cash out its beleaguered venture investors, who have to date sunk $87 million into the business.

So what about that business? It looks good on the surface, I guess. Unique users of the site have more than doubled since 2008, climbing from 5.6 million to 12.7 million. Likewise, revenues have their own hockey-stick trajectory, climbing from $10.6 million in 2008 to $30.5 million in 2010. Losses, too, have been shrinking, from $21.9 million in 2008 to just $6.8 million in 2010. All the indicators are headed in the right direction here. So what's not to like?

First, any company that's planning an IPO will start shaving costs here and there in order to make the trends look good. I have no idea if Zillow's technology and development costs should have dropped from $15 million in 2008 to $10.7 million in 2010. Maybe they're just getting better at what they do, which is computerizing the real estate business. But I doubt it. Everything this company does is on the Internet; their technology costs are going to rise again, probably shortly after their IPO.

Second, it appears to me that Zillow has sold out. The original idea, as I recall, was that the site would bring a degree of transparency to an industry that had long resisted it. When I bought my house in 2005, I sat around a table with about 10 other people at the closing who all seemed to know each other -- my lawyer included -- and who talked as if my wife and I were not there before handing us bills totaling about $30,000.

Zillow was supposed to blow that cabal to smithereens. But a giant plank of Zillow's current growth plans seems to involve signing up agents who want to use Zillow as a listing service. I'm guessing the company's executives are too smart to bite the hands that feed them. If you and I don't pay a dime to Zillow, and agents do, you've got to wonder how ardent they remain about disaggregating the whole process so that you and I don't get burned every time.

The Zillow filing claims that lots of people are using their mobile devices (phones, iPads) to access its "proprietary" and "living" database. (That latter term is a new one to me. I am guessing it's just marketing. Who would claim they have a "dead" database?) But who cares how many people sit in their cars and punch in an address on Zillow in order to see the "value" of a house? The fact is that Zillow, which seemingly could have taken a bite out of the action of real estate transactions by scaring the oligopoly into submission, has demonstrably failed to do so. That they are courting real estate agents themselves is as big an admission of defeat as you might ask for.

Did I mention that Zillow has a dual-class stock structure? And guess what? They're not offering you the B shares. Enough said on that front.

Am I angry that Zillow hasn't provided a buyer for me using their proprietary "Make Me Move" function and my price of $850,000? No. (Still, interested buyers, see here.) Or that the current "Zestimate" of my house's value of $479,000 is almost $200,000 below my purchase price of $661,000 in 2005? No, I am not. (That said, I might be happier with the site if it understood the true value of the place.)

What I'm angry about is that Zillow might have been something that it hasn't turned out to be. The process of buying or selling a house hasn't changed at all since they arrived on the scene. The only thing that's happened is that someone else is taking another piece of the action. If you want a piece of that action, go ahead and buy. But there are better ways to bet on real estate than that.

Wednesday, April 20, 2011

5 credit union perks for the little guy

Credit union perks for the little guy

Better than a big bank?

At credit unions, every person counts and they want you to know it.

Yes, they do usually offer lower fees and better service than big banks. They also serve up some neglected goodies worth scooping up, including discounts on events and cash-back incentives.

How do they pull this off? By pooling buying power.

Since credit unions are not-for-profits owned by their members, they return savings to their membership. For example, auto loan rates are usually 2 percent lower than they are at banks, says Anne Legg, chair of the Credit Union National Association's Marketing and Business Development Council.

"We have everything that big banks have and more," says Todd Pietzsch, spokesman at BECU, a credit union based in Tukwila, Wash. "But a lot of people don't understand the benefits."

To be sure, credit unions come in all shapes and sizes. Some are community based; others cater to specialized groups like police officers or teachers. Many Fortune 500 companies and universities also are affiliated with credit unions. Perks can be equally generous at all of them, says Legg.

Here's a sampling of the perks being offered at credit unions near you.

Credit unions typically offer lower loan rates.

But what about renegotiating loans if you fall behind? At credit unions, the process is usually simple. "You can do it in one phone call," Legg says. "We look at each independent loan to see opportunities."

Still, there may be restrictions, such as paying down part of your loan. And one downside is that renegotiating a loan can tarnish your credit score.

Find discounts on services, entertainment

With a large membership, credit unions can dish out lots of useful, fun discounts. BECU offers discount on sports tickets, tax preparation software and amusement parks, among other perks.